Rumor: Apple offers F1 $2 billion a year for TV Rights (2nd Update)

Seeking Alpha analyst Christoph Liu has given his perspective on a potential game-changing Apple TV Deal for Formula 1 broadcast rights.

Let me begin by the most important news: According to reports, Apple Inc. (AAPL) may be interested in a $2 billion per season for global “broadcast” rights (technologically speaking, “digital distribution” would be more precise, I suppose) deal.

For comparison: that is around twice the combined revenue currently derived from the various broadcast deals with different media partners around the world. The MLS season pass may serve as the blueprint here. Reportedly, its launch brought almost a million new Apple TV+ subscribers virtually overnight, so the rationale for Apple to invest in exclusive sports rights appears rather compelling.

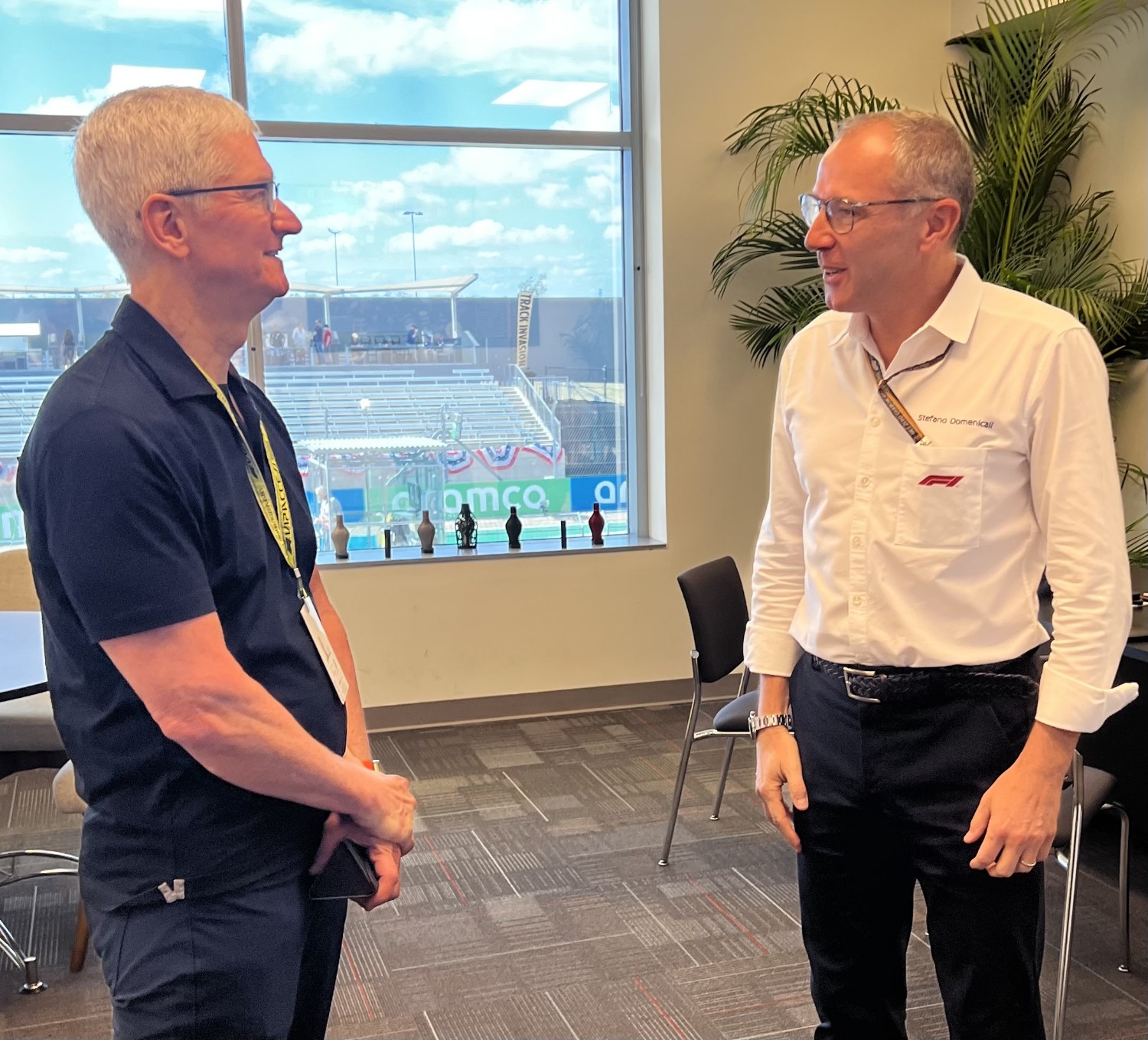

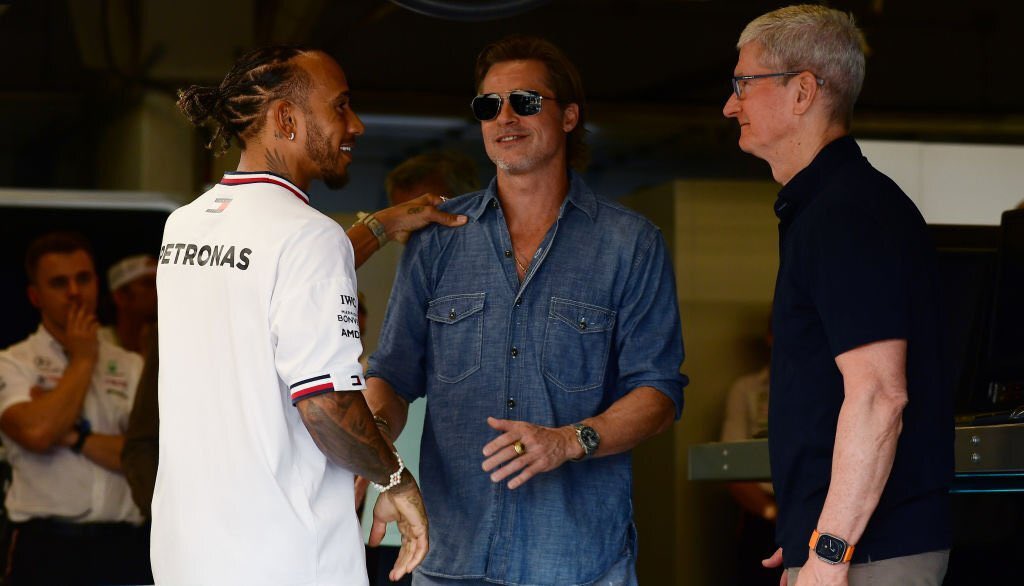

MLS is widely considered to be a second if not third tier football league, mind you (though admittedly, there is the Messi-factor to be taken into account). Formula One, on the other hand, is motorsport’s equivalent to Champions League or a Fifa World Cup. Notably, Apple is already in the process (or had been, until it was forced to halt production due to the Sag-Aftra strike) of shooting an F1 motion picture with actor Brad Pitt in the lead role. The production has been actively supported by Formula One (including Mr. Pitt standing on the grid with real F1 drivers and real in-car footage for use in the picture), so there is definitely a preexisting relationship.

Also, the company is in the advantageous position of not having to worry too much about a billion more or less in cost, unlike most “traditional” media companies.

Besides the substantial increase in rights revenue, an exclusive deal with one global partner may also have the additional upside of potential cost cuts due to said partner producing the content themselves (right now, Formula One produces a so called “world feed” of its events which it distributes to the respective media partners).

Andretti Entry

Another positive development is the possibility of Andretti Autosport joining the series. Regulations (adopted under the so called Concorde Agreements, which are unfortunately, not publicly accessible online; an in-depth analysis can be found here) allow for up to 13 teams. Nonetheless, It could be an obstacle that the existing teams are more or less unanimously opposed to allowing Andretti’s participation in the series. Therefore, Andretti’s entry should not be treated as a foregone conclusion.

An additional American team might increase fan interest for the sport in the US. While there is already the Haas F1 team, the Andretti name arguably has more star power, even more so as there would most likely be a partnership with General Motors Co.’s (GM) Cadillac brand. Regardless of nationalities, an additional team and two additional drivers on the grid naturally increases the potential for storytelling, thus making the series more appealing to fans and more attractive for sponsors and media partners. I therefore believe that Andretti would be beneficial to Formula One Group from a business perspective.

The FIA – which is the governing body of the championship – has already greenlit the entry. Its president, Mohammed Ben Sulayem, is strongly in favor of an eleventh team and made favorable remarks regarding Andretti at various times. Now, it is up to the promoter to decide. If Andretti was denied entry without sufficient reason, that might constitute a breach of European antitrust regulations, which might expose Formula One Group to legal risk.

Under the current Concorde Agreement, a new entrant would have to pay a $200 million dilution fee in order to compensate existing teams for the potential loss in revenue. That fee is not unlikely to rise to somewhere in the range of $600+ million (which is intended to be prohibitive) from 2026 onward, so it is somewhat of a now-or-never situation for a new team.

Financial Developments

Another positive surprise – for me at least, I might have been too pessimistic before – was the financial performance in the second and third quarters. Formula One Group reported Q3 revenue growth of 24 percent YoY (to $887 million from $715 million). Net profit increased by an even more impressive 67 percent (to $107 million from $64 million). That follows a profit growth of 10.7 percent YoY (to $72 million) in Q2, despite the negative impact of the Imola race cancellation due to flood disaster in the Emilia-Romagna region which caused additional cost and lost revenue. The local promoter fee alone (which had not to be paid due to force majeure) is likely somewhere in the region of at least $20 million. It should be noted, that the second and third quarters are generally to be expected to be the strongest quarter due to the season beginning late March and ending late November/early December.

Net debt attributable to Formula One Group slightly decreased to $2.72 billion. The company also announced a repricing of a $1.7 billion Term B loan (from 3.00 percent to 2.25 percent). That is a yearly reduction of interest expenses in the amount of $12.75 million. Certainly not a game changer by any means, but still positive.

Sponsorship development is encouraging, too. I would like to particularly highlight the tire supplier agreement in this regard. Apparently, there has been a bidding war between incumbent Pirelli & C. S.p.A. and Bridgestone KK , with the latter willing to outspend its rival for the privilege. Still, Pirelli was chosen, mainly on the merit of being the known quantity (which is important to the teams engineers, with regard to “understanding” the tires) and a coherent sustainability concept (which is important to some of the sponsors and manufacturers involved for PR reasons). The renewed deal runs through 2027 with the option to renew for the 2028 season. The Italian company has, however, already hinted its intention to retire from the series after the end of the contract.

Just to put a number on it: this deal is estimated to have had a price tag of $30 to $40 million per annum for the last period. While a concrete figure was not disclosed, I assume that it will have increased if anything, but certainly not have decreased given the interest of at least one additional party. So, despite what I thought, there still seems to be some upside in terms of sponsoring, too.

Going forward, it will be particularly interesting to see the financial impact of the Las Vegas Grand Prix (November 18th) – which is hosted by Formula One Group itself instead of cooperating with a local promoter paying a fee – compared to other race weekends. These should be visible when the Q4 results are released.

Risk Factors

As with any investment, there are of course risks to be considered. First of all, there is no Apple media deal, as of yet. There is no guarantee that the offer will indeed be made. And if it does happen, I still see some potential downsides. Most importantly, there is an inherent conflict between exclusive media rights and sponsorship. A sponsor has a vested interest in maximizing exposure by capturing as many eyeballs as possible. Naturally, a paywall is detrimental to that goal.

Furthermore, Formula One Group may face increasing demands by the teams during negations for a new Concorde agreement from 2026 onward. Right now, the percentage of revenue distributed to the teams is independent of the number of teams. If Andretti were to become the eleventh starter, the teams would be all the more likely to demand more money overall in order to not lose revenue. Even without additional competitors, the teams have ample incentives to try to increase their piece of the cake. For a more in depth discussion of this issue, I once again refer to my previous article.

Also, investors should be aware of the fact that Formula One Group is not an independent entity, but a division of Liberty Media Corp. listed through a tracking stock. There is the theoretical risk of Formula One Group being on the hook for liabilities incurred by other parts of Liberty Media, if these are unable to service them. To be perfectly clear, there is no indication of that becoming relevant anytime soon. Still, I believe it is something that should be taken note of.

Valuation and Conclusion

Recent developments merit a reassessment of Formula One Group’s valuation. Also, the stock price is about 9 percent lower compared to the date of my previous coverage. I assume a fair multiple of around 6.5 times revenue, which I based on comparable valuations from other (non-public) sports leagues, such as Spain’s La Liga. I explained my methodology in more detail previously, so, in the interest of brevity, I will allow myself to refer readers to my prior article at this point. Glamorous as it may be, I remain convinced, that Formula One Group as the promoter/rights holder does, unlike a sports team, does not merit a valuation premium as a trophy asset.

If a $2 billion a year Apple rights deal comes to pass, I believe that $3.5 billion in annual revenues is absolutely achievable for the Formula One Group. That would translate to a market capitalization of $22.75 billion which represents a share price of about $88 on an undiluted basis. In a bullish scenario, revenue of closer to $4 billion does not appear too outlandish, either. That would mean a market capitalization of $26 billion and an undiluted share price of around $100. The underlying multiple is what I consider bullish, but still reasonable. So, I would apply a discount of about 15 percent to be on the safer side, thus revising the price target to $75 to $85 per share. That still leaves upside of 30 to 45 percent from the current price level if the Apple deal happens.

October 2, 2023

The Business F1 magazine recently quoted Liberty Media CEO Greg Maffei as expressing concern about “television fragmentation”, warning that even major players like ESPN – with a F1 rights deal until 2025 – is losing ground.

“ESPN, which has been a great asset and is our partner at Formula 1, has declined from 105 million households to 75 million households, or something like that,” he said at a Goldman Sachs event.

“So how do you find that full reach and still get paid? In many cases, you can get an over-the-air provider who gives you full reach, and you can get a premium provider who gives you more revenue.”

Formula 1 declined to comment.

September 29, 2023

Watching Formula 1 Grands Prix live in the future may soon require a subscription to Apple TV, it was rumored on Thursday by Business F1 Magazine.

–by Mark Cipolloni–

Over two billion dollars would be paid by Apple for the exclusive, global rights for the most important series in motorsport. An understandable ambition from Apple, according to Chris Woerts, one of the Netherlands’ leading sports marketers.

While $2 billion per year would be great for F1’s bottom line, team sponsor revenue may drop as a result?

Apple TV has less than 25 million subscribers, but F1 currently gets about 70 million viewers per race. Not all the Apple TV Subscribers would watch the races, so F1 would see a big drop in viewership that would hurt the Team’s bottom line.

However, if F1 would share some of the TV money, like NASCAR does, with the teams, then the teams might be OK with such a deal.

According to the magazine, Apple would consider a bid that the Formula 1 Group “cannot refuse.” It would amount to US$2 billion a year, roughly double what currently comes in for global TV rights for the sport.

The level of exclusivity on offer would increase over the years. Initially, F1 could offer 25 percent exclusivity, but this could rise to 100 percent after five years when the existing contracts expire. The deal offered by Apple would involve a fixed amount of money for the duration of seven years.

From GPblog.com

“For F1 you have to wonder if it is wise, for Apple it would be an excellent choice,” Chris Woerts, former commercial director of Feyenoord and England’s Sunderland, and owner of CWO Consultancy, told GPblog.

“Apple has already had some practice with the worldwide rights – except America – of the MLS. For a few euros a month, Apple lets you watch all the matches in the MLS. That has been boosted by Messi’s presence, and that in turn has boosted Apple TV.”

Something similar could happen to Apple with bringing in Formula 1, Woerts believes: “Their business model (of Apple, ed.) is a bit under pressure. So third-party services, such as Apple Music and Apple TV, are becoming increasingly important. You need to entice consumers to that. Then you need different content that has global coverage. That’s F1 or football. But football is very expensive. If you want to have the Champions League worldwide, it costs five, to six billion. If two billion for F1 is the amount and they want to raise that, that’s actually peanuts.”

Woerts puts it in perspective: “If you peel it down to the number of households, it’s nothing. If you look at Apple’s cash flow, and the availability of capital, it’s actually rounding off their budget.”

Whether Formula 1 would be wise to go into business with Apple TV, Woerts is not immediately convinced. “For Formula 1, it seems like a very good deal, but you take all competition out of the market, also for the long term. So if such a deal is done, it should be for at least five to 10 years,” said the sports marketer, who wonders whether Formula One Management (FOM) could not bring in more by selling the rights on a country-by-country basis.

“That’s down to market forces. With sports rights, you always have uncertain factors: What is the state of the economy? Is there enough competition in a country? Why, for example, did FOM temporarily postpone the tender in the Netherlands? They want to know about Viaplay, and what other suppliers there are. Or maybe they want to do the deal with Apple, then put all negotiations on hold and be done.

But: the FOM could also use Apple TV to drive up prices in other countries. They use it as a kind of leverage: ‘If you don’t sign with us for a lot more money, we’ll go to Apple.'”