Business: Andretti SPAC begins trading on Wall Street, rules out F1 team purchase

Andretti Acquisition Corp., a special purpose acquisition company (SPAC), began trading on the New York Stock Exchange Thursday under the symbol ‘WNNR.U’

The Andretti Acquisition Co, a special purpose acquisition company, or SPAC, raised $200 million in its initial public offering Thursday. Shares were up slightly from their IPO price of $10 in early trading.

The offering is expected to close on January 18, subject to customary closing conditions.

The Class A ordinary shares and public warrants are listed on the NYSE under the symbols “WNNR” and “WNNR WS,” respectively.

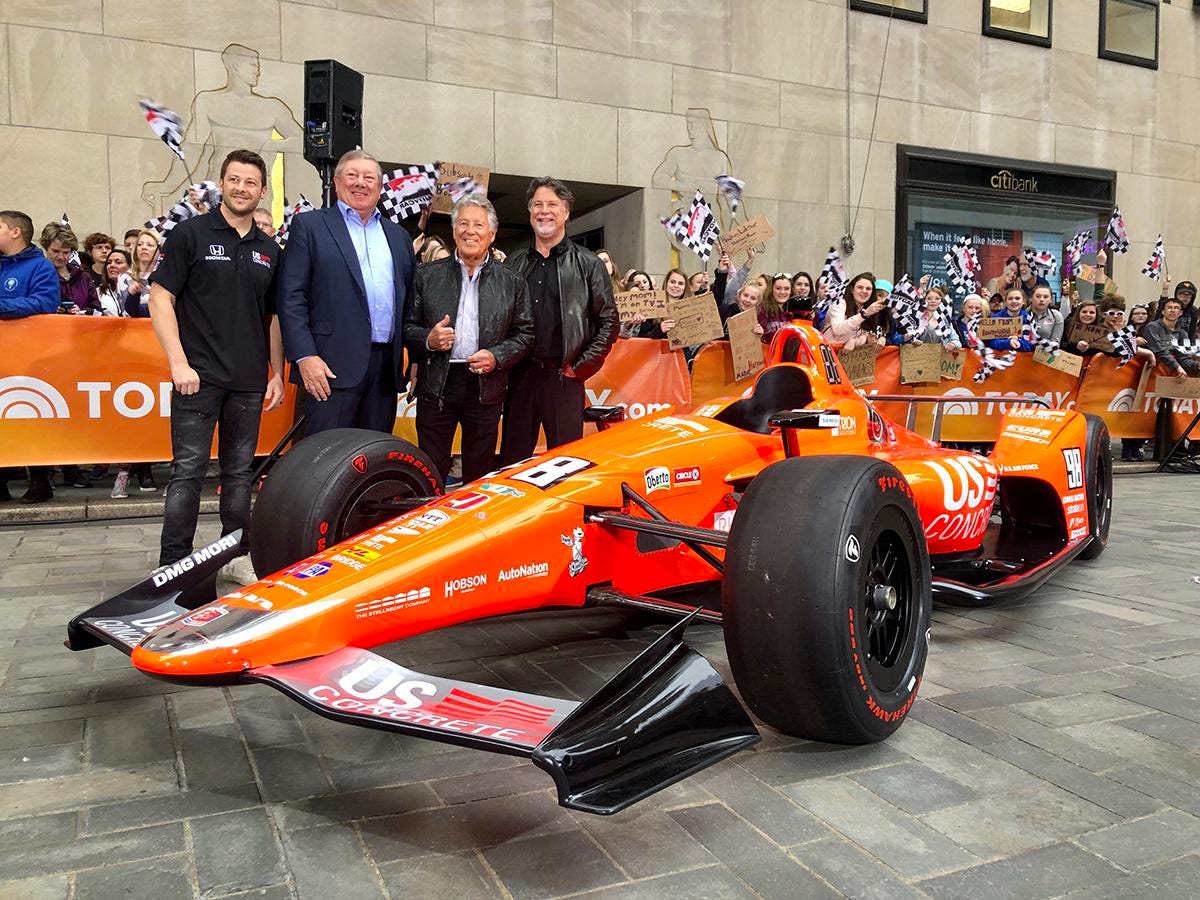

Key principles are Andretti, co-CEO of Andretti Acquisition and head of the Andretti Autosport racing team, as well as his fellow co-CEO, Bill Sandbrook, former CEO of US Concrete, which is now owned by Vulcan Materials (VMC), and chief financial officer, Matt Brown, about what’s next for Andretti Acquisition.

McLaren Racing CEO Zak Brown and Mario Andretti are among the other executives participating in the venture.

On a conference call Matt Brown said that Andretti Acquisition is looking at deals throughout the automotive landscape, including electric vehicles and autonomous cars.

“There are a lot of emerging companies and established companies that could benefit from the Andretti brand,” Brown said, adding that the SPAC is looking to do a deal in the $1 billion to $2 billion range.

Originally, Andretti wanted to raise $250 million, downsizing the fundraising to $200 million in an updated filing in November. The lag between initially filing for a SPAC and follow-through on the public offering has allowed the executive team to better understand the types of deals that succeed in the market, especially with start-up target businesses that don’t have substantive sales yet.

Like many SPACs, Andretti is hoping to bring on other investors through a so-called private investment in public equity, or PIPE, transaction. RBC is advising Andretti Acquisitions as the SPAC’s underwriter.

“There has been a lot of speculation about how I’ve been looking to get involved in Formula 1, but we’re not going to do it through the SPAC, which is independent of Andretti Autosport.” he said. “But Netflix has done wonders for Formula 1 and that’s good for all of racing.”

“I feel like we have a lot to bring to the party—we have a lot to offer, we have our brand, our expertise within the space, we have our contacts,” Andretti added.

Andretti did say that his SPAC would consider acquisitions of companies with ties to the electric auto racing business.

“Our team has a lot of experience in the all-electric Formula E series,” Andretti said. “So if companies we’re looking to buy are in that space, we have a lot to bring to the party.”

Sandbrook hopes to use his business relationships to find the right firm for the Andretti SPAC to merge with, adding that the infrastructure bill that passed in Congress and signed by President Joe Biden last year could lead to more opportunities to buy EV charging companies.

“Between Michael and Mario, they can open any door in the mobility space in the world,” said co-CEO Sandbrook, also on the video call.

The SPAC has already had unprompted calls from various motor sports and auto industry businesses seeking to go public, noted Brown, the CFO. “In a perfect world, we would like to find a company that is generating EBITDA (earnings, before interest, taxes, depreciation and amortization) and that’s also growing quickly.”

The offering is being made only by means of a prospectus. When available, copies of the prospectus relating to the offering may be obtained from RBC Capital Markets, LLC, Attention: Equity Capital Markets, 200 Vesey Street, New York, NY 10281, by telephone at 877-822-4089 or by email at equityprospectus@rbccm.com.