Bad decisions have huge consequences

When it comes to getting TV ratings for cable sports networks, there’s ESPN, and then there’s the rest….by a factor of 6.

When IndyCar decided to take less money from NBC/NBCSN to air its races instead of the more money offered from ABC/ESPN, people with any common sense were dumbfounded.

Bad decisions have consequences.

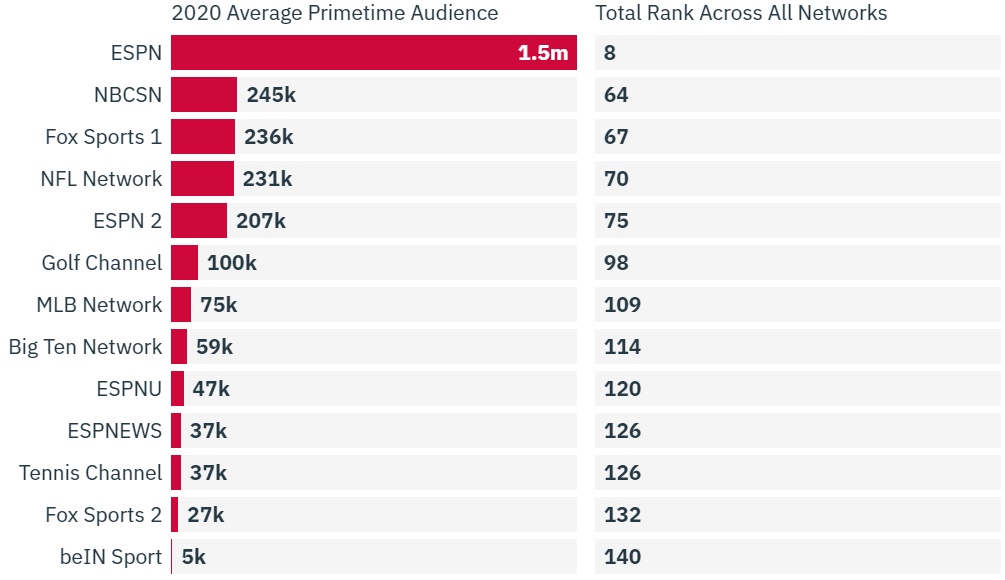

Average U.S. Primetime Audience for Sports Networks in 2020

SOURCE: NIELSEN NPM METER; VARIETY INTELLIGENCE PLATFORM ANALYSIS

What IndyCar’s bad decision meant for its business.

- Less number of network TV aired races – ABC offered 2 to 3 more per year

- Based on average prime-time audiences, NBCSN was the second-biggest cable sports net in 2020, although it trailed ESPN by a factor of over 6. Yes, a factor of 6x (see table above).

- It lost any chance of getting a 3rd engine manufacturer – ratings are too low on NBCSN

- It lost any chance of landing significantly more sponsors for its teams – ratings are too low on NBCSN

- It lost 99% of its international TV audience because NBC has no equivalent to ESPN International

Why NBC is Deep-Sixing NBCSN

The decision to deep-six NBCSN in part reflects its miniscule TV audiences. That coupled with NBC’s uncertainty around retaining the marquee sports on NBCSN, the decision to deep-six NBCSN was almost made for NBC.

NBCSN’s NHL rights expire this at the end of this season, with ESPN already agreeing to a 7-year deal for 100 games a season across Disney-owned platforms and four Stanley Cups in this period, after NBC Sports declined to bid on renewing the current package in its entirety.

IndyCar and Premier League soccer rights for NBC, NBCSN and NBC Gold/Peacock are up in 2022, and NBC Sport’s NASCAR package expires in 2023. Losing two of these four sports in their entirety would see NBCSN schedules somewhat bare, so NBC acted preemptively, and cancelled NBCSN – forcing the losers to move to digital streaming TV with average viewership estimated to be smaller by a factor of 10x.

While there are a finite number of linear TV channels, when it comes to streaming, a new one is popping up almost weekly – meaning the sports TV audience gets split up across an ever-increasing denominator (number of stream channels).

TV audiences lower by a factor of 10 could result in the loss of Chevy or Honda, which would be a detrimental blow to IndyCar; perhaps even fatal.

NBCSN’s closure points to a future where there are fewer cable sports networks on TV. There is a strong likelihood that more of the losers shown in the table above will be folded into streaming platforms.

For sports like NASCAR, IMSA and IndyCar, with its advanced age TV audience – who has no desire to plug into streaming content – look out below if that were to happen.

While NASCAR has high enough TV ratings that a new linear broadcast deal is almost guaranteed, the same cannot be said for IndyCar and IMSA.

Key decisions have consequences, and bad decisions have huge consequences. IndyCar is now paying for their decision to go with NBC/NBCSN as the lights go dark on NBCSN in nine short months.

What will IndyCar’s new TV deal look like? Will all its races remain on linear TV?

If it results in half its races on a digital streaming platform, IndyCar is going to have to hire some good spinsters (i.e. bullshit artists) to put a positive spin on that monkey.

Mark C. reporting for AutoRacing1.com