Musk has a huge mountain to climb in Fremont

|

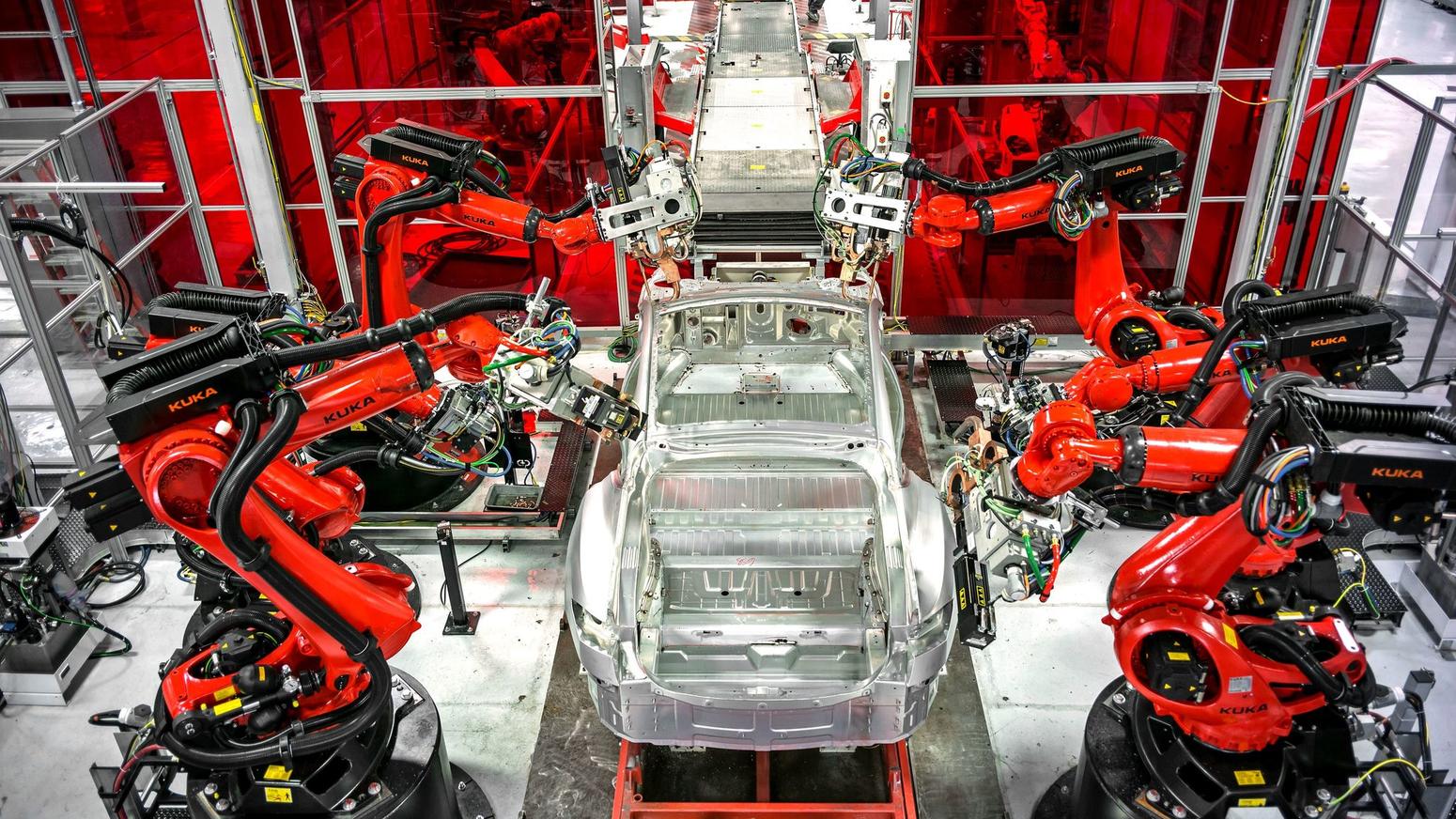

| Can automation help Musk meet his goal? |

SAN FRANCISCO — Elon Musk’s Tesla Inc. may need to come down to Earth on one of the chief executive officer’s most out-of-this-world targets write Dana Hull and John Lippert of Bloomberg.

Tesla’s plan to make half a million cars next year became all-the-more ambitious after the sluggish start the company got off to with its most important electric vehicle yet, the Model 3 sedan. Musk may be confident about solving the unspecified bottlenecks holding back production. But to meet his 2018 goal, he would have to transform one of North America’s lowest-volume auto factories into the second-highest output plant in the region.

“It is a daunting task to launch a new vehicle anywhere," said Kristin Dziczek, director of the industry, labor and economics group at the Center for Automotive Research in Ann Arbor, Mich. “Doing what they are doing, on the growth trajectory that they have set out, is really, really challenging."

Musk, who also leads the rocket company Space Exploration Technologies Corp., is notorious for setting aspirational objectives and falling behind aggressive timelines without fazing Wall Street.

But the problems Tesla is having building as many Model 3s as planned may be a different story. Much of the optimism that’s fueled a 53 percent surge in the company’s shares this year is linked to investors expecting a rapid ramp up in output of Tesla’s first car priced to reach more mainstream consumers.

Tesla is on pace to make more than 100,000 vehicles this year, up from the almost 84,000 Model S sedans and Model X crossovers assembled in 2016 at its plant in Fremont, Calif. The factory ranked No. 65 in production out of the 81 that researcher IHS Markit tracked last year.

For some perspective on just how much of a long shot Musk’s plan is to make half a million vehicles a year at Fremont, consider that the the only plant in all of North America that made that many autos last year was Nissan Motor Co.’s massive factory in Smyrna, Tenn. The facility cranks out half a dozen models including Altima sedans and Rogue crossovers.

The growing pains Tesla is going through in Fremont and the company’s battery Gigafactory near Reno, Nev., may well be weighing on its stock price. The shares have slipped 4.5 percent since the automaker said this month that it made only 260 Model 3 sedans in the third quarter, well below its 1,500-unit forecast. The company has said it plans to make 5,000 of the cars per week by the end of this year.

A Tesla spokesman declined to comment beyond an Oct. 2 statement in which the company said there were “no fundamental issues" with the Model 3’s production or supply chain.

Musk tweeted a photo of Tesla’s Gigafactory team around an early-morning campfire on the roof of the plant Thursday and later reiterated that the company was going through “ production hell."

Musk has said Tesla will build a second car factory to handle production of the Model Y, a smaller crossover model scheduled to arrive as soon as late 2019, and the company is in talks to build a plant in China. While the CEO has told analysts Fremont is capable of handling his half-a-million unit goal, that’s a run-rate the factory has never pulled off before.

Previously operated as a joint-venture between Toyota Motor Corp. and General Motors, the Fremont facility produced hundreds of thousands of vehicles a year during its nearly three decades in use. Formerly called New United Motor Manufacturing Inc., or Nummi, the plant built models including the Toyota Corolla, the Pontiac Vibe and the Tacoma pickup on two assembly lines from 1984 to 2010.

Nummi never hit the 500,000 mark, topping out at 428,636 vehicles in 2006 under its previous owners, according to IHS Markit. Tesla has said it expects to make a million cars a year by 2020, though by then Fremont probably won’t be its only assembly plant.

“Musk is a Category Five breath of fresh air in an industry that really wants to be stodgy and boring," said James Womack, the founder of the Lean Enterprise Institute in Cambridge, Mass., who’s studied Toyota’s production system. “But it’s a tough trick to launch a new product, a new manufacturing system and a new company, and to make it all work in a crazy, crack-brain schedule that Musk may never have believed in to begin with."

In trying to make more cars at the plant than ever before, Tesla is relying on a bigger workforce than the factory has ever seen. The plant — which the UAW has been trying to help employees organize — has more than 10,000 workers, almost double the 5,500 who worked there in 2006.

Tesla may also be adding some factory complexity. While the Model S and X are assembled using aluminum on one line, the Model 3 made on a second line is a mix of aluminum and steel, which could constrain the capacity of Fremont’s paint shop. The company has said it designed Model 3 to be simpler to make than its stablemates in Tesla’s lineup.

“The Model 3 is a mix-material car, which adds new complications — it makes it more complicated when you paint the car, particularly if all of the cars in the plant are running through one paint shop," said Jay Baron, the president and CEO of the Center for Automotive Research.

He added: “Sooner or later, the laws of physics will catch up to Elon Musk." Dana Hull and John Lippert/Bloomberg