The Trend That No One Wants to Talk About

|

| The 1929 Infiniti Q29 Roadster bid to $120,000 but did not find a new owner |

Voila! After four hours of enjoyable motoring, one Starbucks Refresher and half a can of barbecue Pringles, I arrived in St. Charles, Illinois for last weekend's Mecum auto auction in abundantly high spirits. I'm telling you, driving is the only way to go. Not once was I ordered to put my seat back in the upright and locked position, nor was I scanned, groped or violated.

Why is it that so many of us claim to love automobiles, yet we fly everywhere? Ever think about that? Sure, Chicago traffic can get crazy. But it is statistically safer to be roasted alive as a sacrifice to Satan while getting lobotomized with a wooden spoon by cannibals than to be within 641 miles of a TSA agent. So I drive. And I like it.

I was besieged all weekend with questions regarding the auction sales ratio, Mustang price movements, the percentage of active buyers versus spectators, and on and on. Everyone everywhere, it seems, is looking for trends in the collector car market, which is by definition inextricably tied to the economy.

Well, I've got a trend for you. This trend is the elephant in the room that no one wants to talk about. This trend is so obvious, yet so dangerous and politically incorrect that no one in the industry wants to mention it. But it's true. And we'd better wake up and pay attention.

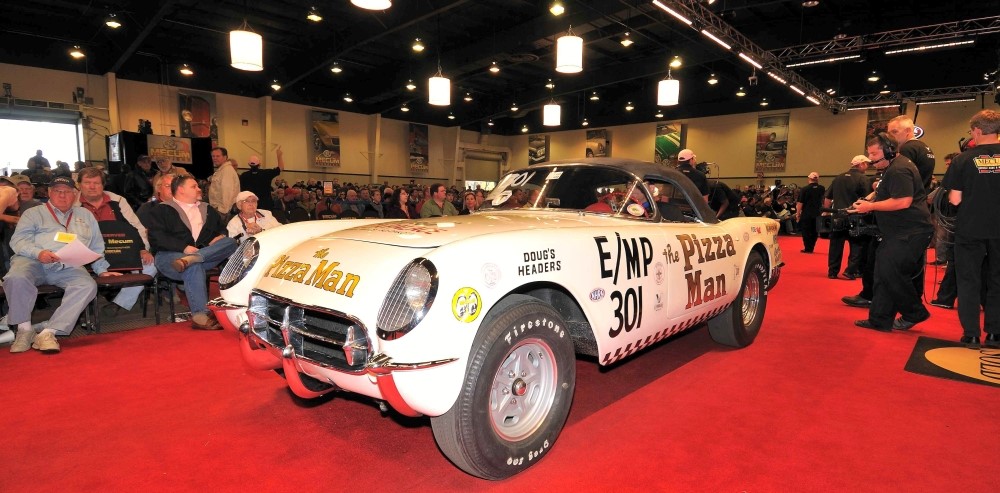

|

| "The Pizza Man," 1954 Corvette 3-time NHRA champion |

Are you ready? Here is the most important trend facing the collector car world today:

Our money is nothing but worthless paper.

Every time the Federal Reserve prints a new dollar, the one in your pocket is worth a little less. And for five years the Fed has been printing money as fast as they can cut down trees.

In the summer of 1980, the price of gas was approximately $1.25 per gallon. So try an experiment – go to this web site (http://www.bls.gov/data/inflation_calculator.htm) and enter $1.25 along with the year 1980, then press “calculate." What does $1.25 in 1980 equate to in 2012 dollars? $3.51. What was the national average price of gasoline this morning according to the AAA Daily Fuel Report? $3.54.

So despite all the whining we hear about rising fuel prices, the simple fact is that the actual price of a gallon of gas in the United States hasn't changed in over thirty years.

If you want to know what is happening in the collector car market, the US economy and the world market, grasp this vital truth: the price of commodities isn't going up, the value of your money is going down. The US dollar is being inflated into worthlessness.

|

| 1970 LS6 Chevelle SS sold for $80,000 |

The Chinese have already figured it out. They're dumping US treasury bonds for other investments like gold, which is the hot new fashion there. The Russians have figured it out. Russian investors are fleeing the dollar and now represent a huge new market for American muscle cars and exotics, which they are buying like hotcakes.

As long as the Fed has the power to magically create money out of thin air without the discipline of a gold standard, the economy will stay in the tank no matter which bought-and-paid-for establishment shill lies his way into office. Why? Because it's the system that's broke, not the dude running it.

Let me ask you a question. Let's pretend that your neighbor has a magic collector car wand. Every time he wants a concours-ready 1963 Corvette, all he has to do is waive the wand, and… presto! A new 1963 Corvette appears! He can do this as many times as he likes.

Now, would you invest your hard-earned money in a 1963 Corvette? Not likely. Your neighbor is going to use his magic wand until he's filthy rich. The market will be flooded with 1963 Corvettes and it won't be long before the value of this magnificent automobile is destroyed.

This is precisely what is happening with the American dollar. What good is a retirement account when the money in it buys less every day? The key is to preserve the value of what you have against a tidal wave of currency inflation.

So the latest trend in collector cars is this… buy one! Buy an expensive one. Buy a cheap one. Buy a Ferrari or a Mustang or a Nova. Just buy one. Or better yet, several of them. Dump your 401k and put your disposable income into something that the Federal Reserve cannot print into worthlessness.

The collector car auction in St. Charles last weekend was an opportunity for everyone at every financial level to secure their wealth in something tangible, authentic and genuine. Cars are real. The demand for them is real. The enjoyment they return to their owners is real.

Buy a collector car. Enrich your life, protect your savings and pick up more chicks all at the same time. It's not just a fun idea, it's a financial necessity.

So, for all of you who were asking about the latest collector car trends, there you go. That's the dirty little secret that has been censored from public debate. That's why smart money from Russia to Finland to Florida is flowing out of stocks and bonds and anything denominated in US dollars and into collector cars.

Now, if I could just convince more people to quit flying and drive them.

Stephen Cox