Apple working on something big, as in a car

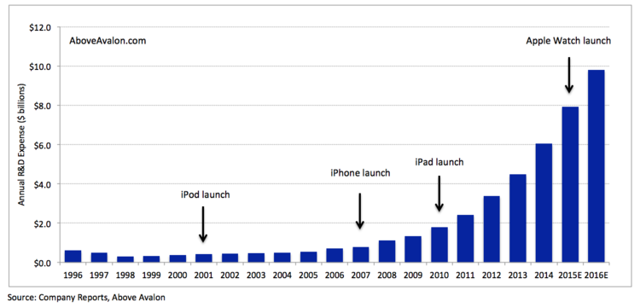

Apple has been a very consistent R&D spender, reporting increased R&D expenditures each year since 1998, with sequential quarterly declines in R&D spend in only six out of the past 38 quarters. Apple is now spending close to $2 billion per quarter on R&D, an amount that's downright remarkable when considering Apple's very lean product line-up can still fit on just one of Jony's wooden design studio tables.

Exhibit 1: Apple Annual R&D Expense (1996 – 2016E)

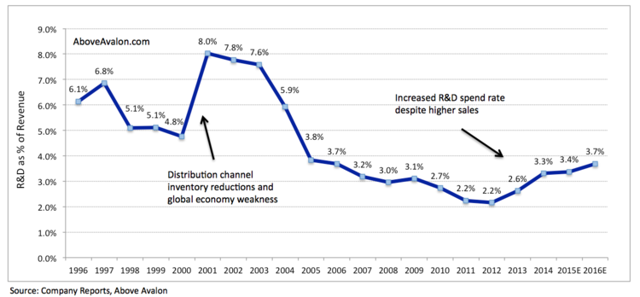

From a modeling perspective, R&D as a percent of sales is the traditional metric used to judge Apple's R&D pace. Exhibit 2 highlights how Apple has allocated additional resources to R&D in recent years as R&D as a percent of total revenue has been increasing. When considering that much of Apple's recent revenue increase has been due to carrier expansion for the iPhone, and not a broad company-wide expansion in product offerings, the recent rise in R&D as a percent of total revenues stands out that much more.

Exhibit 2: Apple Annual R&D Expense as Percent of Revenue (1996 – 2016E)

While pretty straight-forward, R&D as a percent of revenue can be misleading, making it difficult to comprehend how much money is being funneled into R&D. A more relevant and informative way to analyze Apple's R&D spend is to look at the actual dollar increase from year to year. This method is more sensible because Apple has a functional organizational structure with a culture based on placing few, but extremely large, product bets. There's little evidence to suggest that Apple has altered the way it approaches new product development and R&D expenditures. In the past, the bulk of Apple's R&D program has been focused on specific projects and goals. This stands at contrast with a strategy of setting up a number of R&D labs with no clear directive other than to find future products. If Apple is spending R&D, it is a good bet they have a specific goal in mind for those dollars.

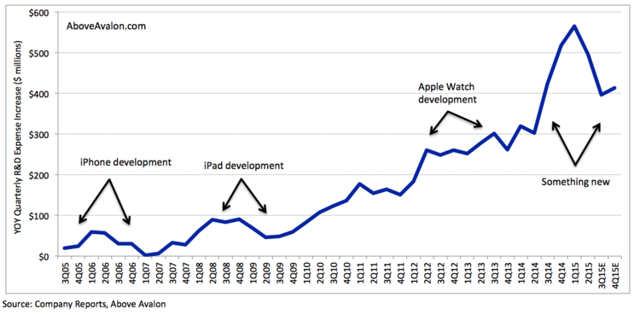

As shown in Exhibit 3, starting last summer, Apple's quarterly R&D expense has increased $500 million from the previous year. This pace is up from the $200-$300 million quarterly increase during the Apple Watch development phase. For perspective, it has been estimated that Apple spent just $150 million developing the iPhone, which can actually be seen in Exhibit 3 when looking at R&D increases in 2005 and 2006. Looking at the recent jump in R&D, I suspect we are seeing the early stages of Apple beginning to add talent and processes for future personal transportation initiatives.

Exhibit 3: Apple Year-Over-Year (YOY) Quarterly R&D Expense Increase (3Q05 – 4Q15E)

The primary reason I attribute Apple's increased R&D expense to personal transport initiatives is most of the evolutionary updates to iPhone, iPad and now Apple Watch would have a difficult time being classified as R&D. Once a project's commercial viability has been established, it becomes that much more difficult to classify manufacturing or evolutionary product updates as R&D expense. In addition, real estate construction costs related to general corporate usage, such as cafeterias, or even design labs where some R&D elements may take place, can not be categorized as R&D. It is even questionable to what degree Apple could have classified Apple Watch manufacturing following the September 2014 introduction keynote as R&D because of questions surrounding commercial viability.

Even though there are a number of accounting guidelines as to what can or can't be classified as R&D, there is often wiggle room as to whether an expense is classified as an operating or R&D expense and run immediately through the income statement, or marked as a capital expenditure and amortized or depreciated over the life of the asset. With that said, the number of explanations for what the recent R&D increase can represent is not long and likely not related to products currently being sold.

In terms of battery technology, Apple may be building up resources and talent in an attempt to push the boundaries as to what can be done with batteries, and not just approach the problem from an improved battery management system, like Tesla. While details on Apple's goals remain few and far between, it is not hard to imagine selling an electric car with a battery that ends range anxiety, or the fear of having insufficient range to reach a destination, is in Apple's best interest. Apple reportedly hired a team of battery experts from A123 Systems last summer to develop "a large-scale battery division," which is likely not just a coincidence with the increased R&D expense at approximately the same time. The other major focal point for R&D may be positioning the automobile for autonomous driving. While a driver may still be required for years, the initial software and technology that can be put into an automobile for accident avoidance is enough to warrant expenditures and research into more autonomous features.

Over the next few years, other than employee hires and fires, the clearest sign of Apple moving forward with a brand new product will likely come down to R&D. I would expect R&D increases to remain lumpy going forward, in conjunction with the progress being made (or lack thereof) with new ideas and processes. As Apple CFO Luca Maestri said on Apple's recent earnings conference call, "(Apple is) developing some core foundational technologies more in house now than we were in the past. And of course we're also spending ahead of some of the products that will generate revenues in the future… Research and development is the core of the company. Innovation is the core of the company." While most people may hear Maestri and think of new smartphone cameras or Force Touch on iPhone, I'm thinking Apple has much bigger and bolder ideas in mind.

Apple's $10 billion annual R&D pace is an indicator that management is looking to move beyond phones, tablets and watches in a quest to find another industry that Apple can bring coolness to, where the status quo has resulted in our expectations for what is possible to be lowered. An industry where Apple can surprise consumers with something new. Neil Cybart