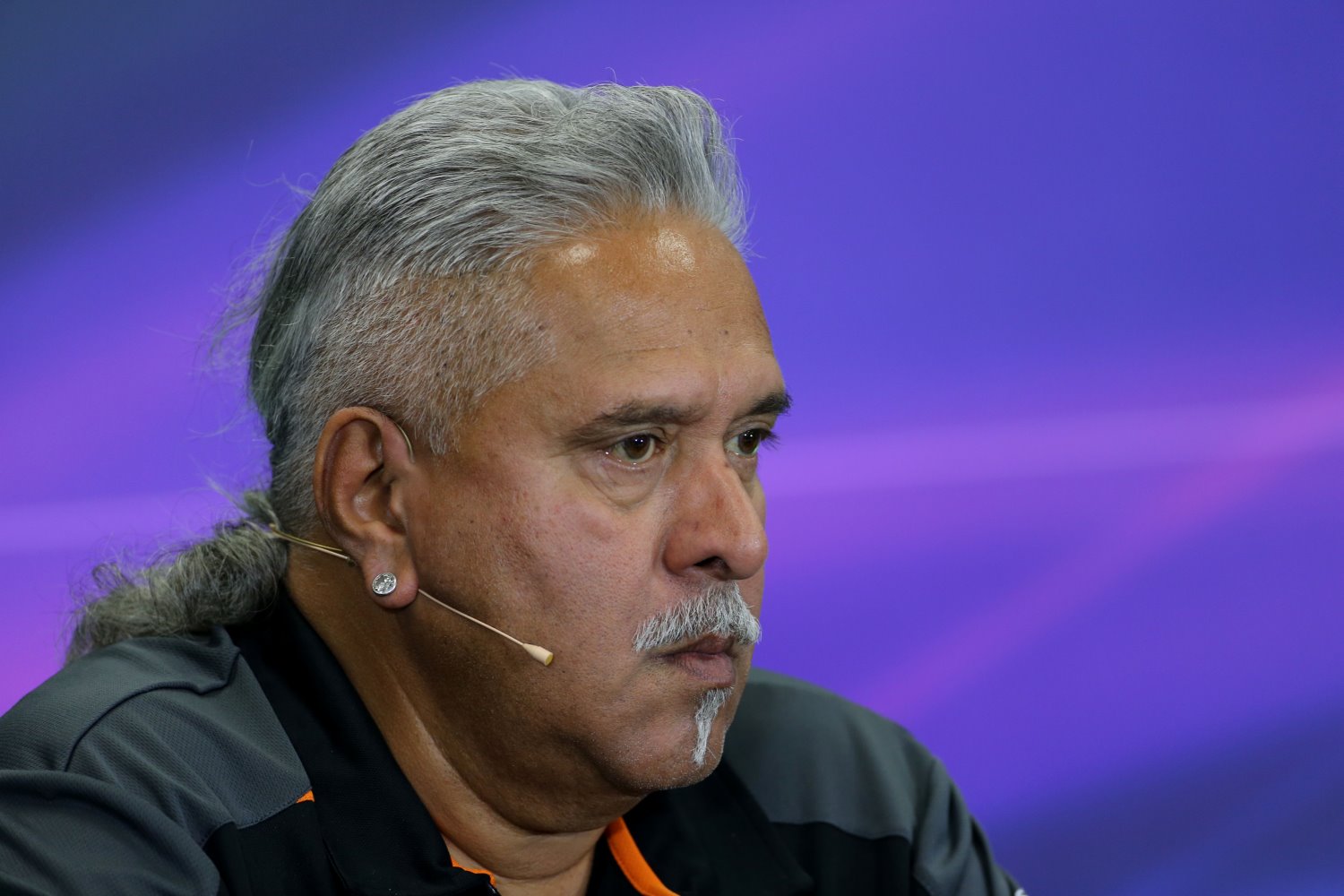

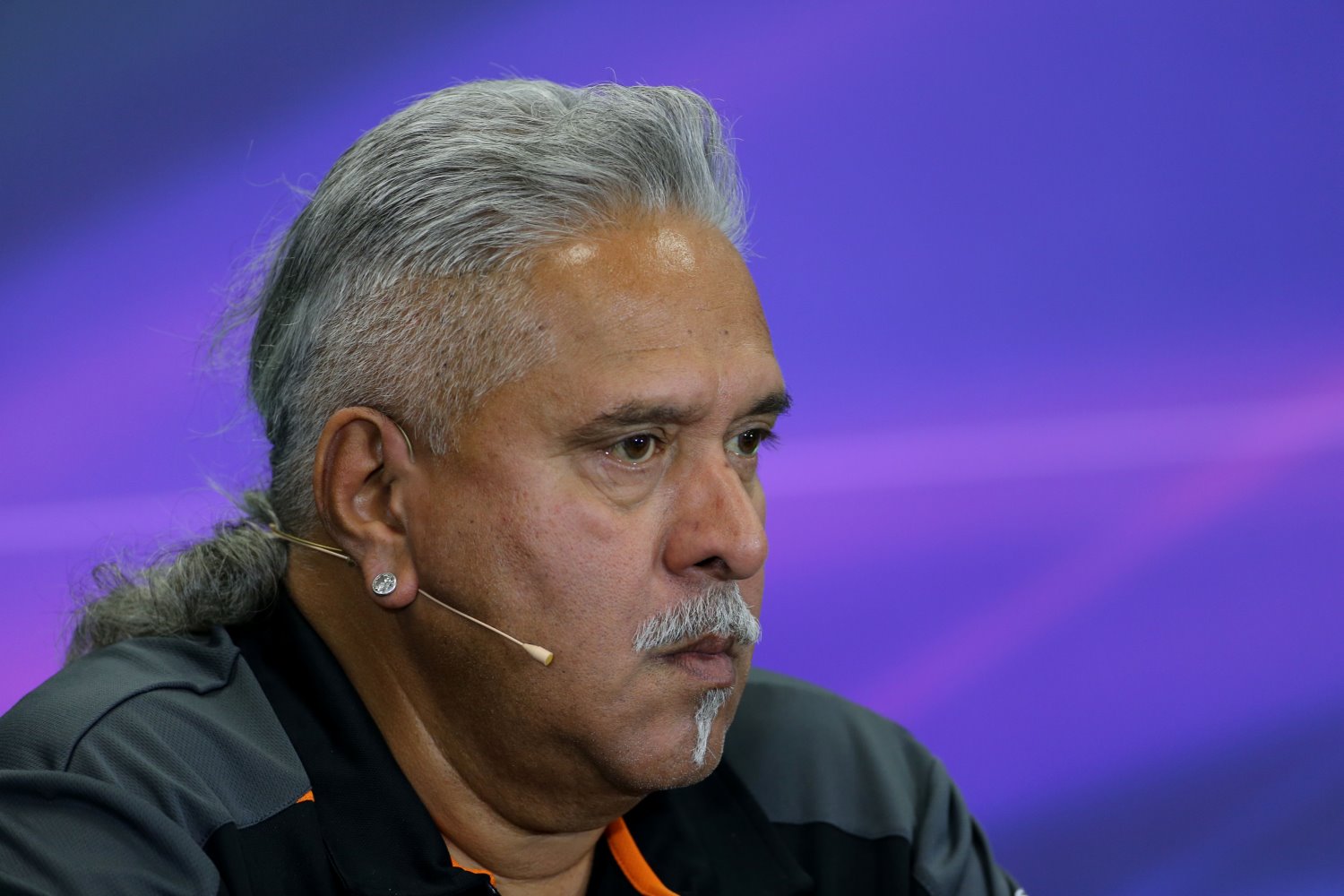

Vijay Mallya Resigns From Indian Parliament

|

| Vijay Mallya |

Controversial liquor baron Vijay Mallya resigned from India’s upper house of Parliament Monday amid a heated public debate and court cases connected to the more than $1 billion in unpaid debt left by his company Kingfisher Airlines.

Mr. Mallya’s Kingfisher Airlines closed down in 2012 and still owes more than 90 billion rupees ($1.3 billion). Lenders say Mr. Mallya personally guaranteed more than $900 million of the loans and have asked Indian courts to help them find his assets.

Mr. Mallya has been in the U.K. as Indian authorities stepped up inquiries into money-laundering allegations against him. Mr. Mallya, chairman of United Breweries (Holdings) Ltd., has denied any wrongdoing and disputes the banks’ account of the size of the debt and the extent of his personal liability.

In his resignation letter to Rajya Sabha Chairman Hamid Ansari, Mr. Mallya said he was resigning as a lawmaker with immediate effect as he didn’t want his “name and reputation to be further dragged in the mud."

“Since recent events suggest that I will not get a fair trial or justice, I am hereby resigning as a member of the Rajya Sabha with immediate effect," Mr. Mallya said in the letter dated May 2nd.

Mr. Mallya’s resignation came a day ahead of the meeting of the Ethics Committee of the upper house, in which the members were set to recommend his removal.

Mr. Mallya was serving his second term as a parliamentarian from the southern state of Karnataka. He was elected as an independent candidate for the state in April 2002 and July 2010. Members of the Rajya Sabha are elected by state legislators.

In the resignation letter, Mr. Mallya said that all allegations against him were “blatantly false and baseless."

“I am shocked that that the Department of Financial Services, Ministry of Finance, Government of India, has provided factually wrong information to a Parliament committee," he said.

A finance ministry spokesperson wasn’t immediately available for comment. Rajesh Roy/Wall Street Journal