Liberty Media Announces Amendment to Formula 1 Financial Covenant

|

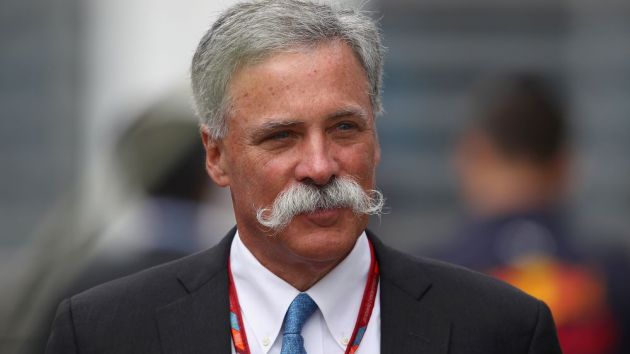

| Chase Carey |

Liberty Media Corporation ("Liberty") (Nasdaq: LSXMA, LSXMB, LSXMK, BATRA, BATRK, FWONA, FWONK) announced today an amendment to the term loan and revolving credit facility of certain subsidiaries of Delta Topco Limited, the Liberty subsidiary that holds all of its interests in Formula 1 (“Formula 1").

“Formula 1 remains the pinnacle of motorsport as it celebrates its 70th anniversary," said Chase Carey, Chairman and CEO of Formula 1. “This new flexibility in our debt covenants, along with a strong balance sheet and ample liquidity, will enable us to weather this difficult time and we are excited to start the season in Austria on 3-5 July. We return to the track with added purpose and determination with our new #WeRaceAsOne initiative."

The amendment has been made to the net leverage financial covenant under the facilities agreement governing the $2,902 million first lien term loan and the $500 million first lien revolving credit facility at Formula 1. The amendment provides that, subject to compliance by Formula 1 with certain additional conditions, the net leverage financial covenant shall not apply until 1 January 2022.

The relevant conditions applicable to Formula 1 include the maintenance of minimum liquidity (comprised of unrestricted cash and cash equivalent investments and available revolving credit facility commitments) of $200 million and certain restrictions on dividends, other payments and the incurrence of additional debt. Formula 1 retains an ability pursuant to the amendment to recommence the requirement to comply with the net leverage financial covenant prior to 1 January 2022 and in which case the relevant additional conditions will cease to apply. As of today, the $500 million first lien revolving credit facility is undrawn. Delta Topco Limited and its subsidiaries, together with the debt described herein, are attributed to the Formula One Group tracking stock.

Forward-Looking Statements

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the benefits of the amendment to the term loan and revolving credit facility, the Formula 1 race calendar, the compliance with certain conditions and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, possible changes in market acceptance of new products or services, changes in law and their enforcement, regulatory matters affecting the Formula 1 business and the impact of the novel coronavirus pandemic (including on general market conditions and the ability of Formula 1 to hold live events and fan attendance at these events). These forward-looking statements speak only as of the date of this press release, and Liberty expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty's expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for risks and uncertainties related to Liberty's business which may affect the statements made in this press release.