The future: Nuclear power and electric cars

|

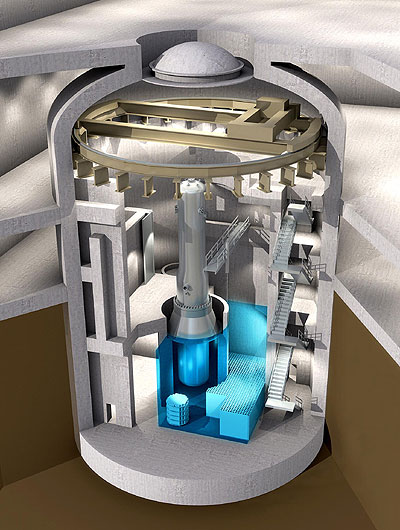

| A small Nuclear Reactor |

America is on the cusp of reviving its nuclear power industry. Last month President Obama pledged more than $8 billion in conditional loan guarantees for what will be the first U.S. nuclear power plant to break ground in nearly three decades. And with the new authority granted by the president's 2011 budget request, the Department of Energy will be able to support between six and nine new reactors.

What does all of this mean for the country? This investment will provide enough clean energy to power more than six million American homes. It will also create tens of thousands of jobs in the years ahead.

Perhaps most importantly, investing in nuclear energy will position America to lead in a growing industry. World-wide electricity generation is projected to rise 77% by 2030. If we are serious about cutting carbon pollution then nuclear power must be part of the solution. Countries such as China, South Korea and India have recognized this and are making investments in nuclear power that are driving demand for nuclear technologies. Our choice is clear: Develop these technologies today or import them tomorrow.

That is why—even as we build a new generation of clean and safe nuclear plants—we are constantly looking ahead to the future of nuclear power. As this paper recently reported, one of the most promising areas is small modular reactors (SMRs). If we can develop this technology in the U.S. and build these reactors with American workers, we will have a key competitive edge.

Small modular reactors would be less than one-third the size of current plants. They have compact designs and could be made in factories and transported to sites by truck or rail. SMRs would be ready to "plug and play" upon arrival.

If commercially successful, SMRs would significantly expand the options for nuclear power and its applications. Their small size makes them suitable to small electric grids so they are a good option for locations that cannot accommodate large-scale plants. The modular construction process would make them more affordable by reducing capital costs and construction times.

Their size would also increase flexibility for utilities since they could add units as demand changes, or use them for on-site replacement of aging fossil fuel plants. Some of the designs for SMRs use little or no water for cooling, which would reduce their environmental impact. Finally, some advanced concepts could potentially burn used fuel or nuclear waste, eliminating the plutonium that critics say could be used for nuclear weapons.

In his 2011 budget request, President Obama requested $39 million for a new program specifically for small modular reactors. Although the Department of Energy has supported advanced reactor technologies for years, this is the first time funding has been requested to help get SMR designs licensed for widespread commercial use.

Right now we are exploring a partnership with industry to obtain design certification from the Nuclear Regulatory Commission for one or two designs. These SMRs are based on proven light-water reactor technologies and could be deployed in about 10 years.

We are also accelerating our R&D efforts into other innovative reactor technologies. This includes developing high-temperature gas reactors that can provide carbon-free heat for industrial applications, as well as advanced reactor designs that will harness much more of the energy from uranium.

Just as advanced computer modeling has revolutionized aircraft design—predicting how any slight adjustment to a wing design will affect the overall performance of the airplane, for example—we are working to apply modeling and simulation technologies to accelerate nuclear R&D. Scientists and engineers will be able to stand in the center of a virtual reactor, observing coolant flow, nuclear fuel performance, and even the reactor's response to changes in operating conditions. To achieve this potential, we are bringing together some of our nation's brightest minds to work under one roof in a new research center called the Nuclear Energy Modeling and Simulation Hub.

These efforts are restarting the nuclear power industry in the U.S. But to truly promote nuclear power and other forms of carbon-free electricity, we need long-term incentives. The single most effective step we could take is to put a price on carbon by passing comprehensive energy and climate legislation. Requiring a gradual reduction in carbon emissions will make clean energy profitable—and will fuel investment in nuclear power.

Mr. Chu is the U.S. Secretary of Energy.

Related Info

As nuclear power generation has become established since the 1950s, the size of reactor units has grown from 60 MWe to more than 1600 MWe, with corresponding economies of scale in operation. At the same time there have been many hundreds of smaller reactors built both for naval use (up to 190 MW thermal) and as neutron sources, yielding enormous expertise in the engineering of small units. The International Atomic Energy Agency (IAEA) defines 'small' as under 300 MWe, but in general today 500 MWe might be considered an upper limit to 'small'.

Today, due partly to the high capital cost of large power reactors generating electricity via the steam cycle and partly to the need to service small electricity grids under about 4 GWe,a there is a move to develop smaller units. These may be built independently or as modules in a larger complex, with capacity added incrementally as required. Economies of scale are provided by the numbers produced. There are also moves to develop small units for remote sites.

Generally, modern small reactors for power generation are expected to have greater simplicity of design, economy of mass production, and reduced siting costs. Many are also designed for a high level of passive or inherent safety in the event of malfunction.

The most advanced modular project is in China, where Chinergy is preparing to build the 210 MWe HTR-PM, which consists of twin 250 MWt reactors. In South Africa, Pebble Bed Modular Reactor (Pty) Limited and Eskom have been developing the pebble bed modular reactor (PBMR) of 200 MWt (80 MWe). A US group led by General Atomics is developing another design – the gas turbine modular helium reactor (GT-MHR) – with 600 MWt (285 MWe) modules driving a gas turbine directly, using helium as a coolant and operating at very high temperatures. All three are high-temperature gas-cooled reactors (HTRs) which build on the experience of several innovative reactors in the 1960s and 1970s.

Another significant line of development is in very small fast reactors of under 50 MWe. Some are conceived for areas away from transmission grids and with small loads; others are designed to operate in clusters in competition with large units.

Already operating in a remote corner of Siberia are four small units at the Bilibino co-generation plant. These four 62 MWt (thermal) units are an unusual graphite-moderated boiling water design with water/steam channels through the moderator. They produce steam for district heating and 11 MWe (net) electricity each. They have performed well since 1976, much more cheaply than fossil fuel alternatives in the Arctic region.

Also in the small reactor category are the Indian 220 MWe pressurized heavy water reactors (PHWRs) based on Canadian technology, and the Chinese 300 MWe PWR such as built at Qinshan Phase I and in Pakistan. These designs are not detailed in this paper simply because they are well-established. Furthermore, India is now focusing on 450 MWe and 700 MWe versions of its PHWR, and China on PWRs of 1000 MWe and higher.

Small and medium reactors with development well advanced

| Name | Capacity | Type | Developer |

| KLT-40S | 35 MWe | PWR | OKBM, Russia |

|---|---|---|---|

| VK-300 | 300 MWe | PWR | Atomenergoproekt, Russia |

| CAREM | 27 MWe | PWR | CNEA & INVAP, Argentina |

| NHR-200 | 200 MWt | PWR | INET, China |

| IRIS | 100-335 MWe | PWR | Westinghouse-led, international |

| mPower | 125 MWe | PWR | Babcock & Wilcox, USA |

| SMART | 330 MWt | PWR | KAERI, South Korea |

| NuScale | 45 MWe | PWR | NuScale Power, USA |

| MRX | 30-100 MWe | PWR | JAERI, Japan |

| HTR-PM | 2×250 MWt |

HTR | INET & Huaneng, China |

| PBMR | 200 MWt | HTR | Eskom, South Africa |

| GT-MHR | 285 MWe | HTR | General Atomics (USA), Minatom (Russia) |

| BREST | 300 MWe | LMR | RDIPE, Russia |

| SVBR-100 | 100 MWe | LMR | Rosatom/En+, Russia |

| FUJI | 100 MWe | MSR | ITHMSO, Japan-Russia-USA |